The term “financial leverage” is a recurring term in the business sector, which means the use of debt to finance business operations or investment.

In this article, we will know what is the leverage, how it works and what are its advantages and its risks.

What is leverage?

Financial leverage is the use of debt to acquire assets that generate more assets.

It is a financing concept used in business operations where the investment is greater than the money that is actually available. To cover the additional money for investment, you simply borrow from financial institutions or from some other sources.

In this way, with a lower amount of equity, you can get a greater chance of profit or loss. It implies, therefore, a greater risk.

The main instrument for leveraging is debt, which allows you to invest more money than is available. thanks to what has been borrowed. But financial leverage can also be achieved through many other financial instruments, such as derivatives, futures or contract for difference – CFDs.

We can find three types of financial leverage:

- Positive leverage – occurs when the profit margin achieved with the leverage operation is higher than the cost of the operation, which is the interest rate paid to the bank for the loan.

- Neutral leverage – exists when the project’s return is equal to the interest rate paid for the loan.

- Negative leverage – occurs when the rate of return obtained by the operation is lower than the interest rate that is being paid for the debt.

How does financial leverage work? Example:

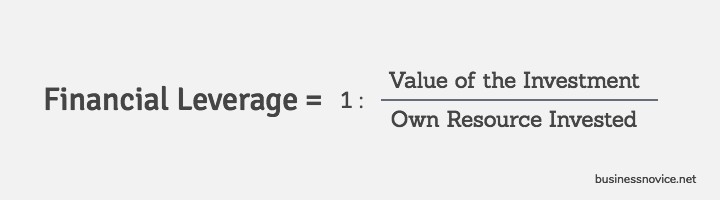

The degree of leverage of an operation is usually measured in fractional units.

A leverage of 1: 2 means that for each available dollar, 2 dollars are being invested. That is, 1 dollar of debt is also invested.

Therefore, the formula to calculate the financial leverage of an operation will be:

Let’s find out how financial leverage works with a simple example :

Without using the leverage: Assume, we want to buy shares of a company that has a market price of $ 1 and we have $ 10,000 of own funds to invest. So we buy 10,000 shares.

After a year, the shares are priced at $ 2, so we sell our shares and get $ 20,000. At the end of the operation, we will have earned $ 10,000 so we get a 100% return.

Using leverage: We still have $ 10,000 of own funds to invest, but we also request a loan of $ 90,000 to a bank and buy the same shares for $ 1. This time, we can buy 100,000 shares.

After a year, the shares are priced at $ 2, so we sell our shares. In this case, we will have obtained a benefit of $ 200,000, with which we will pay the loan of $ 90,000, the interest (for example, $ 10,000) and we would still have a benefit of $ 90,000. Discounting the $ 10,000 initially invested, which is a 900% profitability.

On the contrary, instead of rising in price, if the shares will fall at a price of $ 0.5:

In this case, we would have shares valued at $ 50,000, so we could not face the credit or the interest payment. We would lose our investment and we would also accumulate a debt of $ 50,000.

However, if we had not resorted to leverage, we would only lose $ 5,000.

What are the advantages of financial leverage?

Employing financial leverage has some advantages:

- It allows access to certain investments or markets that, without the support of borrowed capital, would not be possible.

- Increase the IRR of the operation. The financial profitability of our own funds increases exponentially as a result of leverage.

- You can reduce the risk of investment by diversifying your investment portfolio.

Risks of financial leverage

The financial leverage also carries a number of risks :

- The effect of leverage can multiply losses if the return on investment is less than the cost of financing (negative leverage).

- Credit risks. In many cases, interest rates on loans are not fixed, and depend on several variables. If the rates grow faster than the income of the project it is possible that the losses end up being higher than the profits.

- Risk perceived by investors. Highly indebted companies are, on many occasions, unattractive to investors with adversity to risk.

As you can see, financial leverage is a tool that can help to achieve a higher return on investment, but it also entails a high risk.